Bitcoin, in its early days

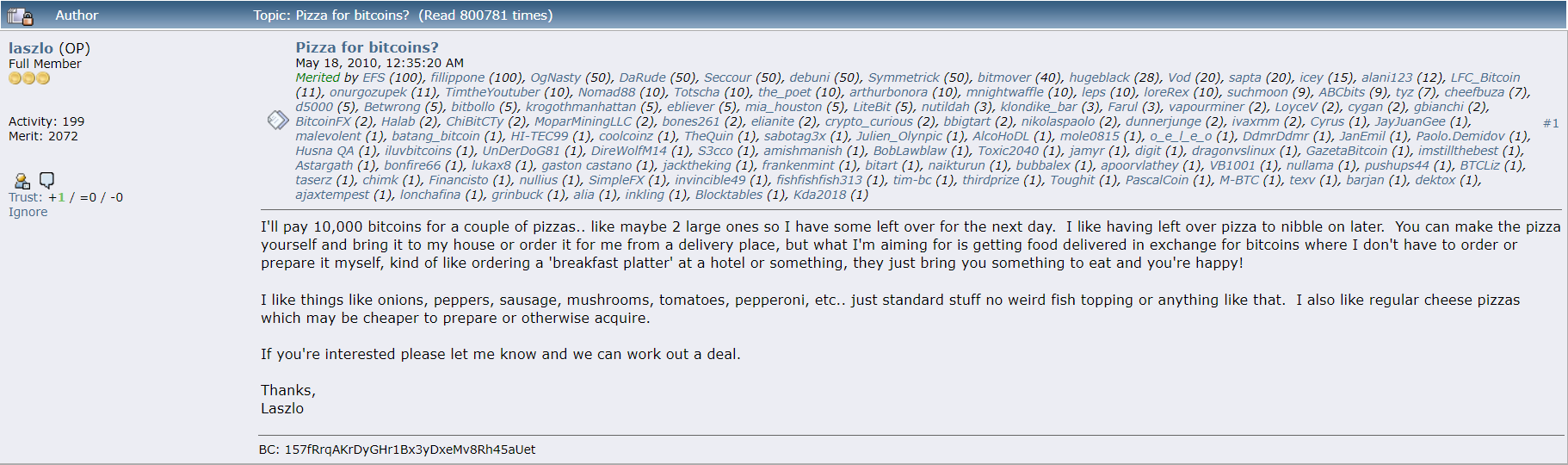

Ever since its inception, Bitcoin has remained the talk of the town. However, people only mined it out of passion, and no one really used it to buy or sell goods and services. Laszlo Hanyecz challenged the status quo and changed people’s perception of Bitcoin by exchanging it for pizza.

Later, in an interview, Hanyecz told The Sun, “I mean, I coded this thing and mined Bitcoin and I felt like I was winning the internet that day.” He added, “I was like, ‘Man, I got these GPUs linked together, now I’m going to mine twice as fast. I’m just going to be eating free food; I’ll never have to buy food again.’”

Hanyecz’s pizza transaction quickly made headlines as it was the first-of-its-kind electronic payment at the time. He repeated it many more times and spent approximately 100,000 Bitcoins on pizza that summer.

Gradually, people started using Bitcoin to exchange goods and services. In early 2010, a Bitcoin enthusiast who went by the name of “dwdollar” on Bitcointalk.org announced that he was creating an exchange platform for Bitcoins. Two months later, on March 17th, the first-ever cryptocurrency exchange platform, Bitcoinmarket, went live.

Until February 2011, Bitcoin wasn’t worth a dollar. Its value was merely $0.003, which means a single dollar was worth 333 Bitcoins. However, things began to change very quickly. By June 2011, Bitcoin’s price had shot up 30 times, reaching a peak of $29.60 on June 8, 2011. The price hike was followed by a steep recession, which caused Bitcoin’s price to drop to $5 by the end of the year.

At the time, Mt. Gox became a notable crypto exchange, accounting for 70% of the total Bitcoin trading volume worldwide. However, the platform suffered multiple security breaches, which caused it to suspend trading, file for bankruptcy, and cease operations in February 2014.

While the collapse of Mt. Gox was an unfortunate event for the crypto community, it didn’t stop Bitcoin from growing at a rapid pace. By then, many major exchanges were facilitating Bitcoin trading, and it was one of the most popular cryptocurrencies, with a market capitalization of $4.4B in December 2014. This is when its widespread adoption began.