Previous Story

Banking The Unbanked — How Can Speed Bitcoin Lightning Wallet Help?

Nearly two billion people worldwide don’t have a bank account. A recent Federal Reserve report revealed that 22% of Americans (approximately 63 million) are either unbanked or underbanked. These people rely on third parties for check cashing services, money orders, loans, etc. This means they often pay higher interest rates and are susceptible to fraud and exploitation.

Lack of trust and exorbitant banking fees were two of the most common reasons people avoid banks. Many low-income households couldn’t maintain the minimum required balance and thus remained unbanked.

Without adequate financial services, unbanked citizens can neither initiate digital payments nor use credit/debit cards to shop online. Unfortunately, they have to rely heavily on cash, which is vulnerable to theft and not very convenient.

Bitcoin can help. Let’s understand how.

With a market cap of $1,388.62 billion, Bitcoin is the first and most popular cryptocurrency on the internet. It eliminates middlemen, such as banks, by facilitating peer-to-peer transactions to any part of the world in seconds.

Bitcoin can help millions of unbanked citizens who have meager earnings and live paycheck to paycheck. It is globally accepted, widely accessible, highly divisible, and easily transferable. Millions of people rely on Bitcoin for their day-to-day transactions. Over 15,000 businesses worldwide accept Bitcoin, and that number is growing rapidly. Whether you want to purchase a house or travel abroad, there is a way you can do it with Bitcoin.

Let’s understand how Bitcoin can bank the unbanked citizens and promote financial inclusion globally.

Bitcoin brings all banking services to everyone, enabling unbanked citizens to participate in the global economy. Let’s understand how.

Many regions around the world lack adequate banking services, making it difficult for people to access essential financial services like electronic money transfers, loans, savings accounts, and insurance.

Bitcoin can fix this. Several platforms like Binance and CoinLoan offer crypto loans, providing easy access to credit to the unbanked. Crypto users can also earn interest on their holdings without needing a traditional bank account.

Millions of people remain unbanked because they don’t have enough money to meet the bank’s minimum balance requirements. To open a bank account, you need a social security number, a government-issued photo ID (passport, driver’s license, or military ID), and a high credit score. Even if you have everything, most banks usually charge a deposit fee and maintenance fees every month to keep your account active.

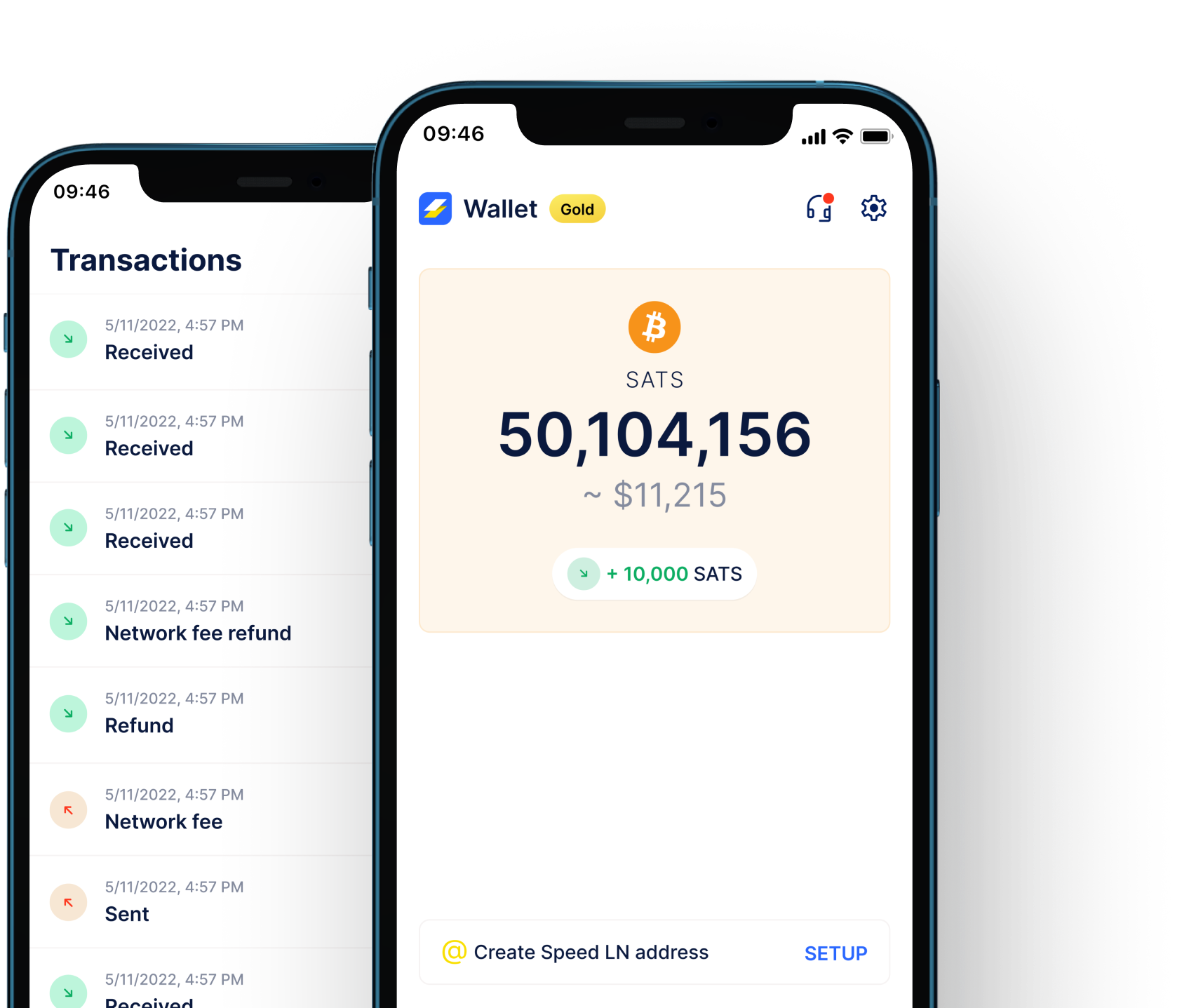

When it comes to Bitcoin, the barriers to entry are fairly low. You neither need a high credit score nor a social security number. All you need is a smartphone and access to the internet for using Bitcoin. Most Bitcoin Wallets, like Speed, will allow you to create an account with just a valid email address.

Download Speed Wallet now to start your journey toward decentralized finance.

Without a bank account, sending money digitally can be challenging. Whether you want to transfer money to your friend living a few miles away or your family living abroad, there is no simple way to transfer funds if you lack access to essential financial services.

On the other hand, Bitcoin can be transferred to any part of the world almost instantly. Because it is a decentralized currency, no central entity is required to approve/moderate Bitcoin transactions as they are direct and peer-to-peer. This means users don’t have to pay hefty transaction fees or wait for days until their transaction is approved. Bitcoin can facilitate near-instant transactions at the lowest fees, enabling people to send and receive money globally.

Bitcoin is globally accessible. Irrespective of your geographical location or financial status — you can use Bitcoin. All you need is a smartphone, an internet connection, and a Bitcoin Wallet to start transacting. No need for a high credit score or to go through strenuous verification processes.

Global accessibility, easy signup, and low entry barriers make Bitcoin an ideal alternative to banks for the unbanked.

Lack of trust was one of the major reasons so many people didn’t have bank accounts. Bitcoin can fix this. It is a trustless system built such that all the participants involved in a transaction don’t have to trust each other or any third party. All the transactional data is stored on a public Blockchain. Anyone from the network can verify a transaction through Blockchain Explorer.

This level of transparency makes Bitcoin an ideal alternative to fiat currency. No one entity can control the Bitcoin network, and new coins can neither be printed at will nor destroyed. Thus, financial institutions, no matter how big, cannot inflate cryptocurrencies. This also means no one can freeze your funds or lock you out of your own account.

Banking charges can become a huge barrier for unbanked citizens. With their meager incomes, they can’t afford the myriad of charges banks levy on depositors. Moreover, the uncertainty of fees and varying account maintenance charges make them wary of banks and other financial institutions.

Bitcoin, on the other hand, is accessible to everyone. There are no charges or any minimum balance requirements for owning crypto. You can sign up with any Bitcoin wallet for free and start using it even if your transaction volume is as little as $1. Whether you transact locally or send international payments, you will only pay a nominal network fee, which is a very small chunk of your total payment.

Bitcoin can help the unbanked be a part of the global economy by providing access to financial services. Unlike banks, Bitcoin has low barriers to entry, can minimize the cost of transactions, and is widely accessible. It will go a long way in promoting financial inclusion, reducing poverty, and fueling economic growth.

While Bitcoin may sound promising, bringing it to the masses can be challenging. After all, playing a game with no rules can be both exciting and terrifying. However, with the right policies and moderate regulation, Bitcoin can help millions of unbanked citizens across the globe.

If you are looking for a reliable means to send and receive Bitcoins, download Speed Wallet today. It is easy to use, supports both Lightning and On-chain transactions, and has the lowest transaction fees. Download now to experience lightning-fast Bitcoin transactions worldwide.

Download now and start your Bitcoin payments journey.